1. Introduction

In the evolving area of finance, it is easy to notice that the DeFi movement has been gaining traction and is changing the way we perceive and engage with traditional finance. Reports suggest that the combined TVL (Total Value Locked) across all DeFi platforms currently stands at $49.31 billion, and further growth is expected. The potential of DeFi ranges widely from better accessibility, transparency, and efficiency while also putting individuals back in control of their financial endeavors.

In this blogpost, we will explore DeFi as an industry and the potential of DIDs to secure the future of finance.

Jump in!

2. Navigating the DeFi ecosystem in depth

2.1 What is DeFi and how does it work?

DeFi, short for decentralized finance, is a relatively new, innovative financial technology that allows participants to engage in direct peer-to-peer financial transactions. Unlike traditional financial systems like banks for example that need intermediaries for transferring money from one bank account to another, DeFi operates on blockchain technology. This allows for more transparent and faster financial transactions. But how does this technology work?

Here’s how.

DeFi transactions are primarily driven by smart contracts. These are nothing but self-executing agreements written in code. This means that when a set of specific conditions for a transaction are met, these smart contracts automatically execute predefined actions. The main idea here is that everything is governed by code and executed on the blockchain. Let us consider an example: suppose a user wants to secure a loan from a DeFi lending protocol. After the user makes a request for the loan on the app and collateral is deposited (in crypto), the smart contract will verify it. If everything is in order, the loan amount will be automatically credited into the user’s wallet — all without an intermediary.

These smart contracts are deployed on decentralized platforms or protocols, which can be thought of as the infrastructure for financial transactions. They often operate using native digital tokens, which are like digital money that can be used as a medium of exchange within the ecosystem. Think monopoly money that can be used to buy assets during the course of the game. The only difference is that most of these tokens can also be converted into fiat or traditional money depending upon exchange rates. Users can interact with these platforms through decentralized applications (dApps), which can provide user-friendly interfaces to access DeFi services.

A larger number of DeFi applications are built on the Ethereum blockchain. Other platforms, like Cardano, BNB Chain, and Solana, are also gaining steady adoption for developing new applications.

2.2 Exploring DeFi industry patterns

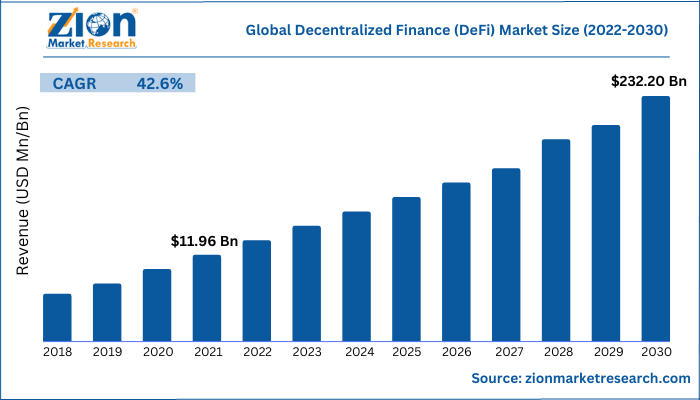

In the last few years, there has been an increased interest in how DeFi works. It has been predicted that the global decentralized finance market size is expected to reach $232.20 billion by 2028. But how did we get here?

The primary reason for this growth has been increased interoperability between different DeFi protocols. This means that users are able to transfer assets between different DeFi applications, even if they are built independently by different teams. Think of it as having different apps on your smartphone that can share information and interact with each other.

Another strong driving force for DeFi’s adoption has been the maturing of blockchain platforms. The much-awaited Ethereum merge, for example, makes the Ethereum Blockchain more attractive to various investors that are looking to make steady yields. Other factors like high levels of transparency and financial inclusivity are also key facilitators of steady adoption.

The ecosystem is continuing to witness innovation. Currently, trends like the monetization of blockchain gaming and building cross-chain technologies for trading across blockchain platforms, are dominating the space.

2.4 DeFi Use Cases

One big use case for DeFi is the development of decentralized exchanges (DEXs), which are basically exchange platforms that allow users to trade cryptocurrencies directly from their wallets. DEXs remove the need for intermediaries, enable peer-to-peer transactions, and enhance user control over assets. Notable DEXs such as Uniswap and SushiSwap have experienced steady growth, with billions of dollars in trading volume.

Beyond DEXs, DeFi has extended its reach into real-world asset tokenization which makes possible the tokenization and fractional ownership of real-world assets, such as real estate, art, and other previously illiquid assets. Tokenize.it and Tangible are some projects that leverage the concept to unlock new investment opportunities.

With DeFi, individuals can also leverage lending/borrowing services to access funds without relying on traditional banks. Platforms like Aave and Compound are working to allow users to lend their digital assets and earn interest. At the same time, users can also use their assets as collateral to obtain loans.

2.5 Challenges with DeFi

- DeFi poses regulatory challenges. Regulators worldwide still do not have a consensus on how to effectively regulate DeFi platforms, token offerings, and dApps and safeguard the platforms against any risks.

- Scams have also become a prevalent problem within the DeFi space due to its open nature. These scams can range from fake token offerings to exploitative lending to fraudulent projects.

- User security is another big concern. Cybersecurity threats, such as phishing attacks and problems in smart contracts, can compromise user funds. Additionally, transactions on the blockchain are irreversible. This means that any shortcomings in the infrastructure of the platforms can lead to financial losses.

Other factors like technical barriers for users who do not yet know the space well, the complex infrastructure of most DeFi protocols, and high gas fees for making transactions on the blockchain also contribute to the slow adoption of the ecosystem.

3. Can DIDs be the solution?

So, the questions we are faced with are: How can the DeFi ecosystem be made more secure to eliminate fraud and scams? What can be done to increase trust for users across dApps in the ecosystem for rapid adoption? Moreover, how can we streamline user experience within the space and make it easier for them to use different applications on different chains seamlessly?

In order to address some of these pertinent challenges, the need is for protocols across the ecosystem to implement cross-chain DID solutions. These can enhance trust and security in web3 projects, make it easier for users to leverage web3 opportunities, and increase adoption.

With DIDs, users do not need to go through the same KYC procedures repeatedly on different platforms. Once they establish their identity with a web3 identity solution provider, they can use it across various dApps paving the way for a better user experience. Having each user’s identity authenticated also means that DeFi platforms will become more resilient to financial scams and avoid malicious actors interfering with the system. Users of a lending or trading dApp, for example, can be more confident in the people they interact with and also securely share only necessary information needed for transactions/loans, without revealing any sensitive data that scammers could exploit.

And this is where Fractal ID comes in.

4. Making DeFi Safer: How Fractal ID Can Help

A leading identity solution for web3 ecosystems, Fractal ID is a vertically integrated identity stack that works for everyone, everywhere. From creating identities to managing access, Fractal ID is committed to supporting web3 projects by fulfilling their unique identity requirements. This includes compliance with data and regulatory standards like GDPR, as well as facilitating easy user verification through Know Your Customer (KYC), Anti-Money Laundering (AML), and human liveness checks.

By integrating Fractal ID into their platforms, Web3 projects — such as DeFi dApps — can establish a secure environment that bridges the gap between security and interoperability. dApp users can avoid repetitive identity verification processes and use their Fractal ID seamlessly across chains like Polygon, BNB Chain, Avalanche, Gnosis, Aurora, XRPL, and Acala. It also empowers them to have complete control over their data and share only pertinent information when engaging with a dApp. By doing so, Fractal ID is not only addressing interoperability challenges in the DeFi ecosystem but also increasing trust for users. This contributes to a more user-friendly and secure DeFi experience, fostering wider adoption and greater convenience for all.

If you are interested in exploring how our DID solutions can help you and your web3 project, book a meeting with our team.

For more information on the topic of DIDs, access our medium articles:

The Future of Data Privacy: Why DIDs and web3 Matter

DID Use Cases: Generating Value With Real-World Asset Tokenization

DID Use Cases: Self-Sovereign Identity For DAOs

DID Use Cases: Decentralized Identity for Sybil-Resistant Quadratic Voting

DID Use Cases: Decentralized Identity For Verifiable NFT Authenticity