1. Introduction

As a critical time for the cryptocurrency market dawns, tokenization is poised to be one of the most transformative developments yet. Real-World Asset (RWA) tokenization is a novel concept that has the potential to revolutionize the way we think about investments and propel the crypto industry into the mainstream. Offering a more transparent, efficient, and accessible way to invest in a variety of asset classes, RWAs are a rapidly growing trend across various business verticals including real estate, art, and even the space economy.

In this article, we explore the current issues with traditional financing, the onset of DeFi, the revolutionary potential of Real-world Asset, and the Fractal ID identity solution to the efficient management of the RWA ecosystem.

Let’s dive into the details!

2. Why is traditional financing no longer the norm?

Centralized financing or CeFi — a system that has been in place for centuries — has been the backbone of the financial industry and asset management. However, its antiquated processes have left many individuals and companies feeling left out in the cold. From the creation of investment products to the distribution of profits, the entire process is often controlled by intermediaries such as banks, brokers, and lawyers. This centralized control has resulted in a lack of transparency, limited access for retail investors, and a high investment risk. Thus creating an uneven playing field alongside significantly halting economic growth.

3. The rise of DeFi: Where do Real-world Assets fit in?

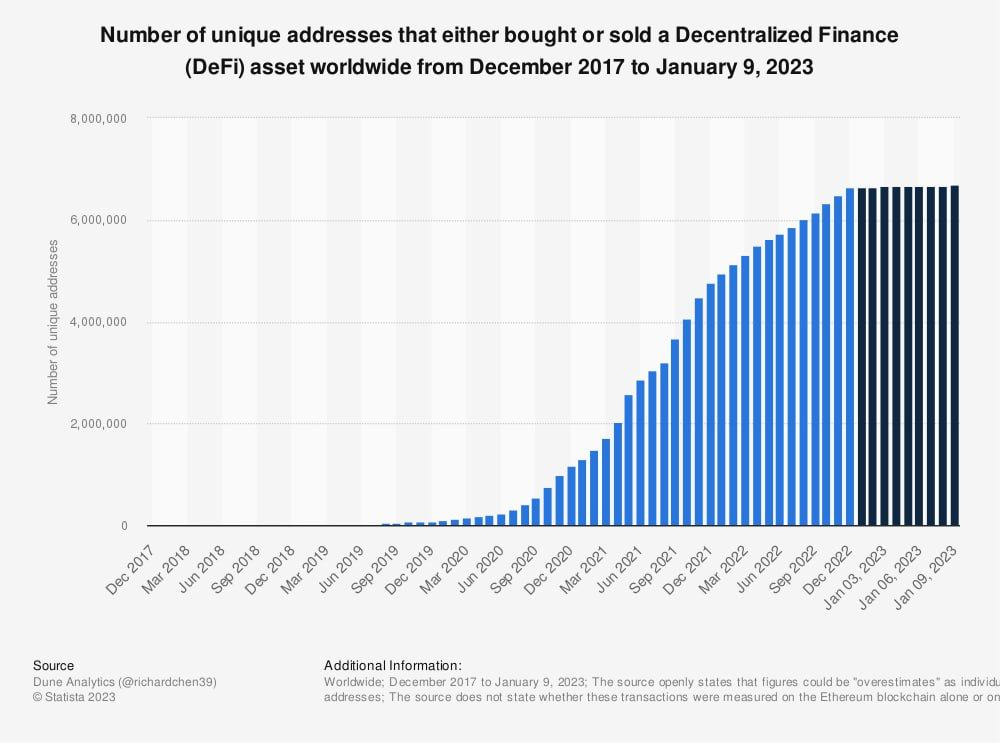

A recent report by Messari suggests that the global financial services industry is currently valued at nearly $23 trillion where $15 billion of value can be attributed to the DeFi sector. The rise of DeFi in recent years can be attributed to several factors — including the growing demand for accessible financial services and greater financial security. By removing intermediaries, DeFi offers greater transparency and control to users, which enhances the efficiency and effectiveness of financial transactions.

Source: Statista

The tokenization of Real-world Assets (RWAs) is a prime example of how DeFi is leveraging blockchain technology to revolutionize traditional finance and investment, allowing for fractional ownership and increased liquidity in previously illiquid assets such as real estate and art. Put simply, Real-world asset tokenization is like turning a physical thing (like a building or a painting) into digital pieces (tokens) that can be bought and sold easily, and the ownership and transaction history of those pieces is recorded on chain. This makes it easier to invest in or own a share of something without the complications of traditional ownership and paperwork. Investors can buy, sell, and trade these tokens on a blockchain-based marketplace, creating new investment opportunities.

4. Real-world Assets: Current market trends

Tokenization allows for a wide range of assets to be digitized and traded in a decentralized manner. Web3 projects like Securitize and Backed Finance are already leveraging the concept of tokenizing RWAs to create entirely new asset classes.

By unlocking broader access to alternative investment, Securitize enables individuals to invest in carefully vetted opportunities through tokenization. Investors can trade private shares in between capital raises and even fund the next generation of world-class startups and projects with security tokens. The secondary market for employee-owned shares is large and growing. This rise of a seasoned market offers alternatives for employees and investors to sell private company equity. Securitize leverage blockchain technology and tokenization to accelerate this process, open the market to more investors along with reducing transaction times and documentation processing requirements for sellers and buyers.

Projects like Backed Finance also leverage tokenization to make public markets more accessible and equitable. Leveraging ERC20 tokens backed by RWAs, the project is able to bridge real-world assets to a new, open financial system. Backed tokens track the value of real-world assets, such as stocks or ETFs. Tokens are freely transferable across wallets and are 100% backed by the underlying asset.

Source – World Economic Forum — Global Agenda Council, BCG Analysis

A couple of examples of assets currently being tokenized include:

4.1 Art

Tokenization has been used in the art world to allow investors to purchase fractional ownership in a piece of art through the creation of digital tokens. This allows investors to invest in high-value artwork that they might not be able to afford otherwise. Alongside, the process also makes it easier to track ownership and ensure the authenticity of an artwork as each token represents a unique and verified piece of art that is recorded on the blockchain. Apart from increasing the liquidity of art, tokenization also paves the way for a more transparent and efficient art market, with lower transaction costs, faster settlement times, and reduced risks of fraud or theft. Platforms like Masterworks allow individuals to invest in popular works of art by using tokenization to enable fractional ownership.

4.2 Intellectual property

Tokenization of intellectual property (IP) on the blockchain involves leveraging smart contracts to create digital tokens that represent ownership and value of a particular piece of intellectual property, such as patents, trademarks, or copyrights. This allows the creators of the intellectual property to sell fractional ownership to investors and receive a share of the revenue generated from licensing or sales. It also reduces the barriers to entry for inventors and creators, as it allows them to raise funds through token sales, rather than relying on traditional funding methods. Molecule is an example of a project leveraging tokenization to build a web3 marketplace for research-related IP.

5. Can Real-world Assets fast-track economic growth?

RWAs address many of the limitations of traditional finance, such as regulatory barriers, and limited access to capital, and have the potential to propel economic growth by unlocking value and increasing liquidity in various industries. By tokenizing assets such as real estate, art, and commodities, previously illiquid assets can now be traded on a blockchain-based marketplace, providing greater accessibility to investors. This enables fractional ownership and diverse portfolios, opening up new investment opportunities and increasing capital flows into these industries. Smart contracts on the blockchain automate various aspects of the buying and selling process, such as payment, transfer of ownership, and settlement, creating a more streamlined and secure process.

6. Why are DIDs relevant for the Real-world Asset ecosystem?

From tokenization in the sports industry where athletes’ contract rights are being tokenized, as reported by Nasdaq, to solving pertinent global issues like Co2 emissions, RWAs are currently witnessing accelerated adoption across business verticals. The need for RWA tokens is critical, and it can change the game for the DeFi ecosystem. However, challenges remain, particularly when it comes to user verification and identity.

The effective management of the RWA ecosystem is crucial for its success, hence, it is important to ensure that asset ownership can be easily and accurately verified for all the participants in the ecosystem, including asset owners, investors, and regulators. The issue gets more challenging with the onset of cross-border transactions in the RWA ecosystem. While tokenization on the blockchain allows for faster, cheaper, and more secure transactions that can occur 24/7, this creates significant regulatory challenges. Since stakeholders may be located in different jurisdictions, meeting regulatory requirements is also an obstacle that hinders massive adoption. Due to the ease of cross-border transactions, regulating and monitoring transactions can become more challenging, leading to potential security and financial risks. Additionally, there is also a pressing need to ensure the privacy of personal data and confidentiality. This requires the implementation of robust data privacy and security measures to prevent data breaches and ensure that personal information is not shared without proper consent.

7. The Fractal ID vision to fast-track massive adoption

Founded in 2017 with nearly 1 Million users across 200+ projects, Fractal ID is the leading identity solution provider for Web3. The project is building a vertically integrated identity stack that works for everyone, everywhere. We help Web3 projects meet their specific identity needs, from data and regulatory standards, including GDPR compliance, to ensuring seamless user verification via KYC/AML checks and human liveliness checks.

With the onset of tokenization and increased adoption, the RWA ecosystem will face the need for proper KYC compliance and identity verification solutions so that trust and efficiency in transitions can be maximized. For instance, trading tokenized real-estate assets might end up requiring compliance with SEC & AML rules.

As a platform specializing in identity verification, Fractal ID offers a variety of identity solutions to address different needs, including Sybil resistance to establish human uniqueness and KYC/AML compliance for regulatory requirements. The range of identity integration options provided by Fractal ID is customized to meet the specific needs of different Web3 projects, starting from the conventional OAuth and moving towards decentralized identity solutions (DID Registry). Offering tailored and web3-native identity solutions, Fractal ID prioritizes a seamless user experience for clients while safeguarding the privacy of users.

By integrating Fractal ID’s identity management technology, asset tokenization platforms can also enhance the security of their platform by implementing a decentralized and tamper-proof identity verification system. This can help to reduce the risk of fraud and increase transparency and trust between platform users.

If you are interested in exploring how KYC and decentralized identities (DIDs) can help you and your business, book a meeting with our team.