“Some of our portfolio projects have used Fractal ID’s services for their private sales, while others have asked for a uniqueness solution for their platform. We heard good feedback from our teams about those solutions!”

The leading KYC/KYB provider for investors and businesses

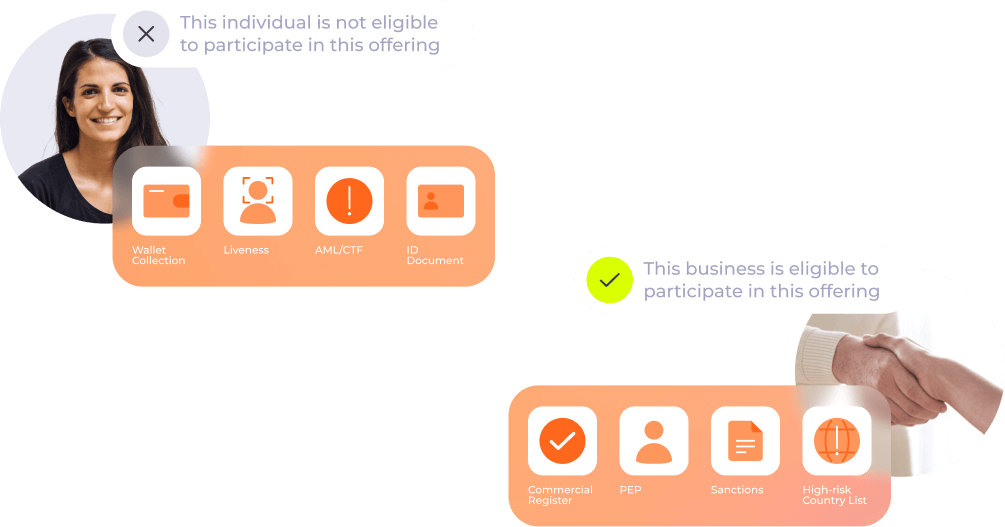

We provide comprehensive onboarding solutions for both individual investors (KYC) and businesses (KYB), ensuring a seamless and efficient process. Our services cater to a wide range of entities, including accelerators, VCs, private sales, and public sales/IDOs.

Benefits

Reliable Due Diligence

Having access to verified information about companies or projects, minimizes risks and

supports informed decision-making. Fractal ID offers a robust identity verification and compliance framework, enabling venture capitalists, accelerators, and ICOs to conduct reliable due diligence on potential investments.

Info textRead more

Streamlined

Process

Fractal ID takes care of all the necessary checks and requirements, ensuring

compliance with regulations and industry standards. This saves venture capital, accelerators, private sales, and ICOs time and effort by handling the complexities of investor due diligence.

Info textRead more

Smooth

onboarding

Say goodbye to cumbersome paperwork and manual processes. Our platform offers a user-friendly interface (including a no-code option) enabling your clients and partners to complete the KYC verification smoothly and efficiently, reducing onboarding time and friction.

Info textRead more

Offering

Compliance for Private Sales and Public Sales/ICO

We simplify KYC and KYB for Private Sales and Public Sales/IDOs with tailored solutions that ensure a compliant and efficient onboarding process. Our expertise in the regulatory landscape enables us to navigate the complexities of each funding avenue, ensuring adherence to relevant laws and regulations.

and many others

Compliance for VCs and Accelerators

Whether you’re an accelerator seeking to attract promising startups or a VC evaluating potential investments, our tailored KYB and KYC solutions facilitate the necessary due diligence. We help assess financial stability and evaluate regulatory compliance, allowing you to make informed decisions and focus on your core objectives.

and many others